Press Release

We deliver news to keep our customers and shareholders happy.

PRESS detail

SK networks 2021, KRW 11.02 trillion in sales, KRW 121.9 billion of operating income

2022-02-10- YoY sales increased even under the COVID19 pandemic through robust growth of the rental business.

: Market leading activities were seen as SK rent-a-car’s used car sales profit went up, on-line exclusive products were released and the country’s largest EV complex development has been ongoing.

: Meaningful achievements including SK magic’s eco-friendly product development, rental service in partnership with Samsung and product launching on Amazon.

- Transformation to ‘Operation based investment company’ will be accelerated this year through global investments and more focus on blockchain.

It was demonstrated that SK networks laid a strong foundation for future growth through sustained growth of its rental subsidiaries, SK rent-a-car and SK magic despite the COVID-19 influence last year.

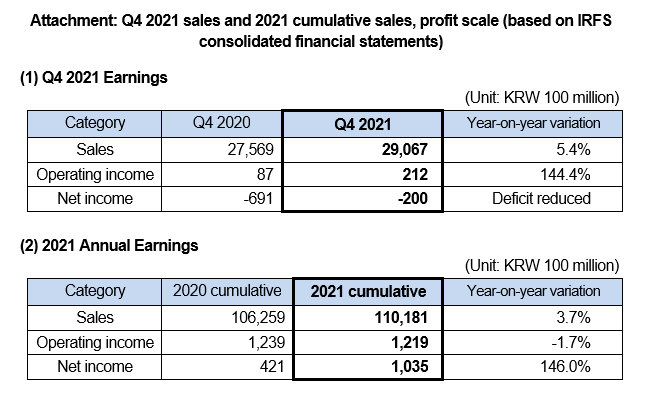

On February 10, SK networks (CEO: Sang Kyu Park) announced through a provisional performance disclosure that it recorded KRW 2.91 trillion in sales (5.4% year-on-year increase) and KRW 21.2 billion in operating income (144.4% year-on-year increase) for Q4 2021 based on consolidated financial statements. Accordingly, the cumulative annual performance recorded sales of KRW 11.02 trillion and an operating income of KRW 121.9 billion. When compared with 2020 results, the sales increased by 3.7% and the operating income was maintained at a similar level (1.7% year-on-year decrease) as the previous year despite continued loss from hotel business due to C0VID-19.

In Q4, ICT profits increased with the new iPhone release and as MINTIT, the ICT recycle brand recorded an annual transaction of one million used phones. SK magic launched its products on Amazon, the largest e-commerce company of the world, and it reached 2.21 million accumulated rental account of by introducing innovative&hygienic home appliances one after another. Favorable business conditions continued for SK rent-a-car with successful short-term rent-a-car program in Jeju, increased selling price of used cars and tire sales increase through SpeedMate and TIREPICK. It should be noted, however, an year-on-year decrease in profits was reported from active marketing activities such as advertisement campaigns and pop-up stores targeted at improving brand awareness of ‘SK Rent-a-car Direct’, an online exclusive pricing/quotation service newly launched by SK Rent-a-car.

2021 in terms of earnings can overall be summarized as a year of growth led by the mobility (e.g. SK rent-a-car) and home care (SK magic) that showcased new products and services, leading the respective markets.

SK rent-a-car has been structuring a strong foundation of EV rental business through the development in Jeju, the largest of its kind in the country, and its efforts have also been directed to set up a base for contactless online market with ‘SK rent-a-car Direct’. In addition, a pilot service called ‘SK rent-a-car Tago Pay’ with a service fee scheme based on the rented vehicle’s driving distance was introduced last year which is now officially live this year. SpeedMate has sought to increase customer satisfaction by launching the ‘Club SM’, a membership-based vehicle management service while Cartini (brand name: TIREPICK), spun off from SK networks last October, has been working to further grow into an online platform provider.

SK magic unveiled its Green Collection, a lineup of eco-friendly home appliances last autumn and released All Clean Air Purifier ‘Green 242’ which is almost entirely made of eco-friendly plastic. Also, having launched ‘the Special Rental Service’ last year in partnership with Samsung, it has been expanding its service areas into life and environmental sectors as well as various home appliances. As a result, SK magic successfully achieved KRW 1 trillion in sales for two consecutive years.

In the case of Walkerhill, the impact driven by Covid-19 was inevitable as the operation of accommodation and food and beverage service has been reduced. However, it managed to cut down the loss by launching package PB package promotions to meet the trends and showcasing ‘the Print Bakery Walkerhill Flagship Store’ and ‘Walkerhill Picnic Eco Bag’. It further announced its transformation into an eco-friendly hotel to accelerate ESG management.

This year, SK networks plans to actively get engaged to develop the momentum of growth and expand business opportunities in mid- to long-term perspective for the sake of producing stable business results from the existing areas and full transformation into a ‘Operation based investment company’. In particular, global areas as well as professional investment and business development in relation to blockchain will be supported intensively as essential business areas for future growth. For this, the Blockchain Business Division in addition to the Global Investment Center were newly organized through the 2022 regular organizational restructuring carried out at the end of last year, and the Company is seeking opportunities for investment partnership with startups that have high growth potential. This has led to a series of investments this year in ‘LVIS’ a digital healthcare company, ‘MycoWorks’ an eco-friendly materials company and ‘Everon’ an EV charging company in addition to the recent MOU with ‘Hashed’ a specialized blockchain investor. These efforts will be brought further as a strategy to build an investment process of virtuous circle to achieve value increase of and profit creation from invested companies followed by reinvestment. Efforts will also be in place to bring ESG management to a higher level in consideration of both the society and environment.

Through this, SK networks will not only strive to improve its ability to put financial stories into reality and thereby increase the corporate value, it will continue to evolve into a company that will live up to expectations of various stakeholders including the investors. An SK networks executive emphasized, “Our goal as a Operation based investment company is to make this year a year of results and growth by responding with flexibility to changes in the management conditions and ensuring a highly competitive investment portfolio.”

- PREV

- NEXT