IR News

Create future value through transparent management.

IR News detail

SK Networks achieved an operating income of KRW 237.3B in 2023, a 33.6% increase compared to the previous year.

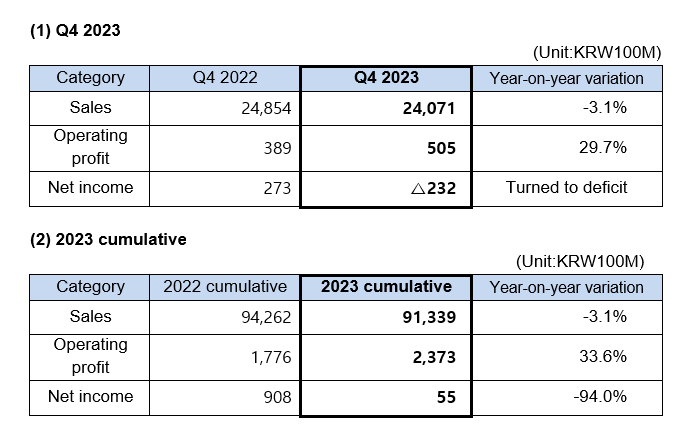

2024-02-13- Q4 2023 records: KRW 2,407.1 billion in sales and KRW 50.5 billion in operating income, with an annual cumulative record of KRW 9,133.9 billion in sales and KRW 237.3 billion in operating income. The numbers signal a substantial expansion of profits.

- Commitment to shareholder-friendly management was demonstrated through resolutions to increase regular dividends to 200 won and retire 6.1% of treasury stock.

- “As an operation-based investment company centered around artificial intelligence, we will drive innovations to lead the SK Networks Renaissance.”

SK Networks, raising its value as an AI-centric business oriented investment company, achieved an operating income of KRW 237.3 billion, a nearly 33.6% increase compared to the previous year. This achievement was made possible through proactive business portfolio adjustments and profitability enhancement despite challenges in the industry’s overall business environment. To share this achievement with shareholders, the company increased the regular dividend to 200 won per share and decided to retire 6.1% of treasury stock, actively enhancing shareholder value as an business oriented investment company.

On February 13, SK Networks (CEO: Hojeong Lee) announced through a provisional performance disclosure that it recorded KRW 2,407.1 billion in sales and KRW 50.5 billion in operating income for Q4 2023 based on consolidated financial statements. Walkerhill and SK Rent-a-Car demonstrated strong performances.

However, SK Magic incurred a decrease in net profits due to costs associated with discontinuing its kitchen appliance business to strengthen its competitive edge at the end of the previous year.

The annual cumulative sales and operating income amounted to KRW 9,133.9 billion and KRW 237.3 billion, respectively. Compared to the previous year, sales decreased by 3.1%, while operating income increased by 33.6%. The analysis indicates that a substantial expansion of profits has occurred based on improvements in the structure of Walkerhill and major investee companies.

Following the launch of the NFT-based membership W.XYZ, Walkerhill celebrated The Buffet’s renewal open in the fourth quarter of last year on a grand scale and introduced various customer-centric services such as the K-pop Tour Program with popular idol group NCT Dream. The resulting increase in room occupancy and use of other facilities led to a successful turnaround, showing a clearly different picture from the COVID-19 period.

SK Magic restructured its organization, focusing on the rental business, and established a growth strategy to evolve into an AI-based product and service company. In the fourth quarter of last year, it also showcased the All-Clean The Art Air Purifier featuring washable fans, the first of its kind in South Korea. These advanced technological capabilities were recognized at CES 2024, where three SK Magic’s products won innovation awards.

SK Rent-a-Car created a steady sales performance increasing its profitability by expanding overseas sales channels for used cars while also trying to cater to various customer needs by launching the Monthly Car Rental and B2C Certified Used Car programs.

On this day, the SK Networks Board of Directors approved a dividend increase and treasury stock handling plan to enhance shareholder value. Accordingly, the regular dividend increased to 200 won (225 won for preferred stock) from the previous 120 won (145 won for preferred stock). In addition, it was determined to retire 14,500,363 treasury shares in March. This accounts for 6.1% of the total shares, amounting to KRW 77 billion (based on average acquisition price). The company has decided on another large-scale retirement of treasury stock this year, following the 5% retirement last year.

Through such shareholder-friendly decisions, SK Networks is viewed to meet the market and stakeholder expectations while further elevating its value as an operation-based investment company linked with advanced technologies such as artificial intelligence (AI) and robotics.

SK Networks plans to crystalize its identity and strengthen its profitability this year, aiming to solidify its status as a company capable of sustainable growth. As it can be seen from the recent MOU with Vivek Ranadivé, Managing Director of Bow Capital and NBA Sacramento Kings team owner for the SK Networks Renaissance Project, SK Networks aims to explore significant growth opportunities in areas like AI and robotics with prominent global partners. The identified opportunities will be integrated with existing businesses such as SK Magic, Encore, and Walkerhill to create new business models. Additional achievements are anticipated through early-stage support and management focused on Silicon Valley facilitated through the U.S. subsidiary.

SK Networks CEO Hojeong Lee stated, “Following last year’s successful performance and despite challenging conditions we will drive innovation more decisively and quickly this year as an AI-centric business oriented investment company,” and emphasized, “We will unite organizational capabilities and lead SK Networks’ renaissance so that the shareholder return policy, reflecting management’s commitment, may lead to greater shareholder value creation and corporate value enhancement.”

- Previous

- Next