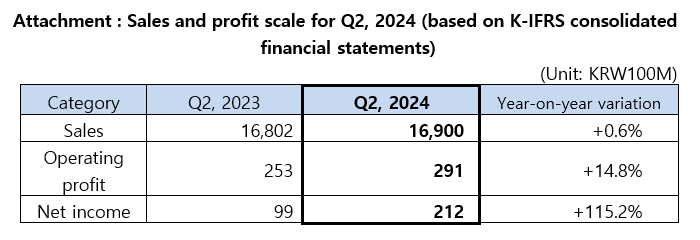

SK Networks posted Q2 revenue of KRW 1.69 trillion, with an operating profit of KRW 29.1 billion.

-

2024-08-12

- SK Magic and Walkerhill improved competitiveness and profitability, leading to a 14.8% rise in operating profit compared to the previous year. The optimization of the business portfolio involved divesting SK Rent-a-Car and spinning off current businesses.

- Plans are in place to introduce a 100 won interim dividend to increase shareholder value.

- “Advocate for the shift towards AI-focused business models contingent upon a solid financial foundation”

Amid unstable economic circumstances both domestically and internationally, SK Networks has received its Q2 report showing that efforts to improve business profitability have paid off.

On the 12th this month, SK Networks (CEO: Hojeong Lee) revealed its preliminary financial results, disclosing a total revenue of KRW 1.69 trillion and an operating profit of KRW 29.1 billion for the second quarter on a consolidated basis. Even though sales revenue was on par with the previous year, operating profit saw a 14.8% increase from the same quarter last year, fueled by SK Magic and Walkerhill's strong performance.

SK Magic released a range of innovative products with advanced technology and design, including the Ultra-Small Direct Water Purifier and One-Cork Ice Purifier, which captured the attention of customers. Operating profit rose due to improved efficiency in SG&A, advertising expenses, and other expenditures.

As for Walkerhill, there was a growth in room bookings and food and beverage sales due to various customer satisfaction initiatives like monthly packages, the Harrington Car Driving program, and early summer offerings. Furthermore, the demand for overseas travel has led to an increase in the popularity of Incheon Airport lounges and transit hotels.

Speedmate, a well-rounded brand specializing in automotive maintenance and repair, also saw a boost in profits thanks to a thriving maintenance division and enhanced efficiency in its auto parts export sector.

In addition to the second quarter results, SK Networks also carried out portfolio adjustments to move towards AI-focused business models. In June, the board of directors authorized the sale of its subsidiary SK Rent-a-Car to Affinity Equity Partners for KRW 820 billion, and the transaction is currently in its final phases. The company also opted to separate Speedmate and its trading divisions to streamline the management structure between the parent company and its subsidiaries for better management effectiveness. It is expected that this will accelerate SK Networks' transformation into an AI company through a holding company structure with strong financial stability.

SK Networks has also announced a new interim dividend of 100 won per common stock, after canceling 77 billion won worth of treasury shares and raising the regular dividend to 200 won earlier in the year. By aiming to distribute business profits to shareholders, the company will continue to enhance shareholder value.

Looking ahead, SK Networks aims to efficiently complete the process of adjusting its business portfolio and establish AI-driven business models throughout the company. By doing so, the company aims to solidify its position as a sustainable company that aligns with its stakeholders, such as employees and shareholders.

An official from SK Networks mentioned that PhnyX Lab is being established as a skilled organization to implement and support AI-focused business models, as well as develop AI-powered services for SK Magic, Walkerhill, and other business units. They emphasized the importance of integrating AI into their current operations by cultivating AI expertise internally and investing in companies with cutting-edge technologies to enhance their future growth strategies.