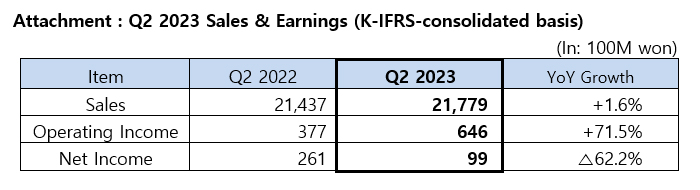

SK Networks Announces Second Quarter 2023 Results, Posting Revenue of KRW 2.2T and Operating Profit

-

2023-08-09

- 71.5% increase in operating profit compared to the same period last year attributed to strong performance across all business lines ··· highest-ever since Q3, 2019

- Series of investments in AI & data management tech firms to create synergy with existing business portfolio

- “We will enhance our corporate value as a Business-oriented Investment Company, with synergy of existing businesses innovation & investment.”

Demonstrating even growth trajectories across the entire business lineup, SK Networks has unveiled a notably improved performance in the 2nd quarter in comparison with the same period last year and the preceding quarter.

SK Networks (CEO: Ho Jeong Lee) announced in the preliminary performance disclosure on the 9th that the company raked in 2 trillion 177.9 billion won in sales and 64.6 billion won in operating income in Q2 on a consolidated basis. Year on year, the sales have increased by 1.6% and the operating income has surged by 71.5%. SK Networks demonstrated improvement overall in its business lines including Walkerhill, ICT, Speedmate as well as two rental service subsidiaries, SK Magic and SK Rent-a-car, bolstering anticipation for additional achievements in the 2nd half of the year.

SK Magic succeeded in rebounding as the new product trio - One-Cock Iced Water Purifier, Susuro Plus Tankless Water Purifier, and New Slim Water Purifier – met with favorable customer responses. Moreover, efforts to improve profitability by expanding the share of online distribution channels and saving costs contributed to profitability gains.

SK Rent-a-car retained stable revenue records primarily powered by long-term rental contracts. Customers also continued to favor its services including ‘Smart Link’, the vehicle management solution, and ‘TAGO BUY’, allowing users to take over rented pre-owned vehicles cars at their discretion. The company also propped up operating income by diversifying used car export channels.

Walkerhill, as social distancing measures ease, showed significant increase in revenue as demands for guestrooms, food, and beverage jumped drastically and sales at Incheon Airport transfer hotel and Matina Lounge boosted. Furthermore, increase in visitors to exhibitions and conventions added spurs to its performance upside. The ICT business saw operating income rise due to cost saving effects of streamlining logistics while MINTIT, leveraging AI-powered technological edge, led the proliferation of used mobile phone trade culture and achieved a profitable quarter.

The chemical trading business posted stable financial results based on long-term contracts while Speedmate remained on a steady growth track thanks to increase in imported car parts sales and profitability. SK Electlink continued to roll out more infrastructure, installing ultra-fast EV charging stations in 62 expressway stops in June and solidifying its presence as No.1 private fast EV charging service provider with over 2,700 fast EV chargers in operation.

SK Networks has also made investments in AI technology to uncover potential sources of future growth. SK Networks announced investment not only in the AI-powered wearable device developer ‘Humane’ early this year and but also in the AI smart farm solution startup ‘Source.ag’ in May. Along with these moves, SK Networks met with Managing Director Vivek Ranadivé of Bow Capital, a leading venture capital in Silicon Valley, and OpenAI CEO Sam Altman in a row to discuss possible partnership opportunities in a bid to expand global tech. investment/business initiatives. SK Networks’ board of directors recently resolved on acquiring ‘En-core,’ a leading data management company of Korea, to promote synergy between business and investment in the AI domain.

SK Networks plans to ensure stability and growth into the 2nd half with continued commitment to enhancing the competitiveness of its business portfolio. Simultaneously, it envisions increasing its corporate value under the vision of a ‘Business-oriented Investment Company’ through investments in promising future domains and innovation of existing businesses.

“The outcomes of aligning business and investment strategies in a unified direction are now bearing positive results in mobility, AI, etc. across the parent company and its subsidiaries,” an official at SK Networks said. “We will continue to boost up corporate value in the 2nd half by flexibly responding to changes in business landscape and bolstering up the competitive edge of investment portfolio.”