SK networks will raise corporate value based on the achievements from early-stage investments and also seek shareholder value enhancement and global investment community expansion.

-

2023-02-22

- The first Global Annual General Meeting (AGM) to enhance the global investment stakeholder network

- The U.S.-focused ‘Hicosystem’, hyper investment network, was built according to the strategy to become a business-oriented investment company.

20 investments worth $176M have been executed with a focus on U.S. investment and the performance is relatively strong.

- A panel discussion took place with leading global venture leaders.

- “We will assume the role as the Global Innovation Gatekeeper to raise shareholder value and share investment performance and visions with stakeholders.”

“SK networks will assume the role as the Global Innovation Gatekeeper based on its successful investment experience in Silicon Valley, U.S. We will not remain complacent in innovations that make our daily life easier but leverage our influence to address various kinds of social and economic inequalities around the world.” (SK networks President & COO Sunghwan Choi)

SK networks announced on February 22 that the Global Annual General Meeting was held at Walkerhill Hotels & Resorts (Gwangjin-gu, Seoul) to brief the relevant industry stakeholders about its status of global investments and future orientation. SK networks has been working to transform itself into a business-oriented investment company and has invested in technology-based startups that will lead the future.

This meeting held on February 21 was launched this year to introduce SK networks’ global investment projects and their achievements and enhance communication with stakeholders. In addition to President & CEO of SK networks Ho Jeong Lee, President & COO Sunghwan Choi, the meeting was attended by more than 150 domestic and foreign investment industry stakeholders including Founder & CEO of Sabanto Craig Rupp, CEO of MycoWorks Matthew Scullin, and Managing Partner of Kindred Ventures Steve Jang and partner companies that are expanding the magnitude of their collaboration with SK networks in the global market.

After President & COO Sunghwan Choi gave a welcome speech, video congratulations were extended by President Garry Tan of Y Combinator, a startup accelerator that launched thousands of startups and Co-founder & CEO Mohammad Shaikh of _ 1 blockchain project Aptos (APT). Garry Tan who became the President of Y Combinator after Sam Altman, the co-founder of Open AI that developed ChatGPT, caught the attention of the audience that day. Later, Head of the New Growth Division Hanjong Jung took the stage to explain SK networks’ journey for transforming into a business-oriented investment company, global investment status, and future orientation.

■ 20 investments worth more than $176M are in progress based on the global investment network Hicosystem.

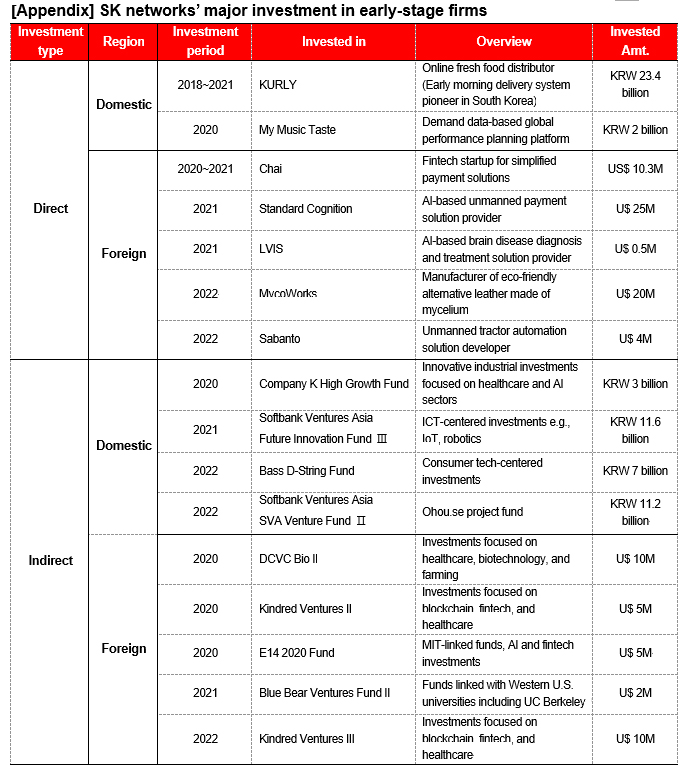

SK networks started investment in early-stage firms (referring to firms that require an investment at the beginning period after foundation) in 2018. The next year, President Sunghwan Choi joined SK networks and began to fully engage in investment capability building and execution reinforcement, setting the direction for the company’s evolution into a business-oriented investment company. SK networks’ business-oriented investment company model refers to a business constantly raising its corporate value centered on investment by, for example, investing in high-growth potential areas and upgrading existing business models using the relevant technology at the same time and incorporating them as the company’s key businesses, if necessary. To identify new growth engines that will build up growth and sustainability, SK networks’ investment has targeted Silicon Valley, the so-called heart of global innovation, as well as South Korea.

SK networks set out to form its network based on the idea that investments in early-stage firms are made through groups of experts. While the network started by meeting one after another, it gradually expanded and eventually led to the establishment of the Hicosystem, composed of more than 220 people including founders, investors, and experts in technology, economy, and law. In this process, President & COO Sunghwan Choi is known to have played a leading role in building the Hicosystem and SK networks’ internal capabilities based on his strategic insights, overseas business expertise, and experience of being in charge of SK Group’s first U.S. startup investment when he was working for SK Inc.

In 2020, after building the global investment network, SK networks established a U.S. investment arm Hico Capital in Silicon Valley and has actively engaged in investment activities since then. Summing up the investments currently being made, there are 20 investments for both fund investment and direct investment that amount to $176M. Head of the New Growth Division Hanjong Jung said, “In the early days of making investments in the U.S., we mainly targeted global top-tier funds for deal sourcing and utilization of investment verification channels, which were also linked to direct investments” and added ”Now that the investment management system is in place, we are increasing direct investments.”

In line with the technological evolution, SK networks’ direct investments place focus on digital transformation, Web3, and sustainability. This principle has directed SK networks to invest in an AI-powered autonomous checkout solution provider Standard Cognition, an autonomous tractor solution provider Sabanto, and MycoWorks which produces eco-friendly alternative leather made of mycelium. Jung explained the background of SK networks’ investment zoning saying, “Future technologies are shifting to offer the best possible convenience to humankind and at the same time emphasize the connectivity between people. The market that restores environmental values will expand explosively as well.”

To date, SK networks is recording a higher level of IRR (internal rate of return) for investments in early-stage firms compared to general global funds. It is analyzed that this achievement is attributed to SK networks’ own in-depth, three-stage investment review process and post-investment management.

SK networks will continue to upgrade its investment management system, while at the same time seeking to leverage internalized capabilities to introduce the U.S. market to stakeholders in South Korea. Jung said, “We will contribute to accelerating global innovation through portfolio expansion based on the investment network and management system and lead it to shareholder value enhancement,” and emphasized, “We will further enlarge the global investment community by exploring ways for Hico Capital to share future visions and investment performance with those interested in investing in early-stage U.S. firms.”

■ President & CEO of SK Networks Ho Jeong Lee said, “We will take advantage of diverse investment portfolios to evolve into a business-oriented investment company.”

CEOs of three companies among those invested by SK networks were invited to the stage at the Global General Annual Meeting. CEOs of MycoWorks, Sabanto, and MyMusicTaste took the stage to introduce their vision, current business status, and plans, which was followed by Q&A sessions with the attendees.

Managing Partner of Kindred Ventures Steve Jang and Managing Director of Hico Capital Samuel Kim also spoke about implications related to the AI industry and Web3 ecosystem. During the speech, Steve Jang said, “Just as ChatGPT has the limelight in that it communicates with humans, the ultimate purpose of using AI is to support humans,” and added, “It is again important for Web3 founders and their teams to forecast the needs of future customers and be able to develop and service them.”

In addition, a panel discussion took place under the theme of ‘Changes in the macro economy and corporate activities.’ SK networks President & COO Sunghwan Choi joined the discussion as a panel along with the leaders in the venture industry including Softbank Ventures CEO JP Lee and Hashed CEO Seojoon Kim. Lee said, “AI and resale are gaining increasing attention amid the economic recession and liquidity crisis. This will lead to an increase in corporate investments to reduce cost and improve quality through technology.” Kim emphasized, “Blockchain and crypto are vessels that hold the future of capital markets. Given that more and more blockchain-based applications such as account abstraction are permeating our daily life, we should more aggressively take advantage of related technologies.”

The Global Annual General Meeting was concluded by President & CEO of SK networks Ho Jeong Lee. Lee once again underlined the importance of investment in the company’s business management strategies. Lee further announced that SK networks will strengthen its role as the Global Innovation Gatekeeper and evolve into a business-oriented investment company through the innovation of existing businesses and additional growth engines.

President & CEO Ho Jeong Lee said, “Investment is an essential function that all companies must have to remain sustainable. SK networks’ global investment projects will play important roles of linking existing businesses with future businesses and increasing corporate value,” and added, “Please join us in our story of the evolution into a business-oriented investment company leveraging diverse investment portfolios made by SK networks and Hico Capital.”

The Global Annual General Meeting was hosted by SK networks at the Theatre des Lumieres, an art gallery located on B1 of Walkerhill Hotels & Resorts. The main exhibition space with a scale of 3,400m2 in total area and 21m in height featured a façade video that visualized SK networks’ investment cases and achievements, presenting an overwhelming sense of immersion. Three-dimensional video congratulations from global economy and financial industry leaders also caught attention. The audience reacted with applause when a person in the opening video that depicted Human Life Advancements through Future-Benefiting Technologies emerged from the darkness and transformed into President & COO Sunghwan Choi.

[Photo 1] SK networks’ Global Annual General Meeting at a glance

[Photo 2] SK networks President & COO Sunghwan Choi is giving a welcome speech at the Global AGM.

[Photo 3] SK networks President & CEO Ho Jeong Lee is giving a closing message at the Global AGM.

[Photo 4] SK networks Head of the New Growth Division Hanjong Jung is briefing the audience about the company’s global investment projects.

[Photo 5] Managing Partner of Kindred Ventures Steve Jang (right) and Managing Director of SK networks Hico Capital Samuel Kim are speaking about implications related to the AI industry and Web3 ecosystem.

[Photo 6] Softbank Ventures Asia CEO JP Lee, SK networks President & COO Sunghwan Choi, and Hashed CEO Seojoon Kim (from left to right) are participating in the panel discussion.