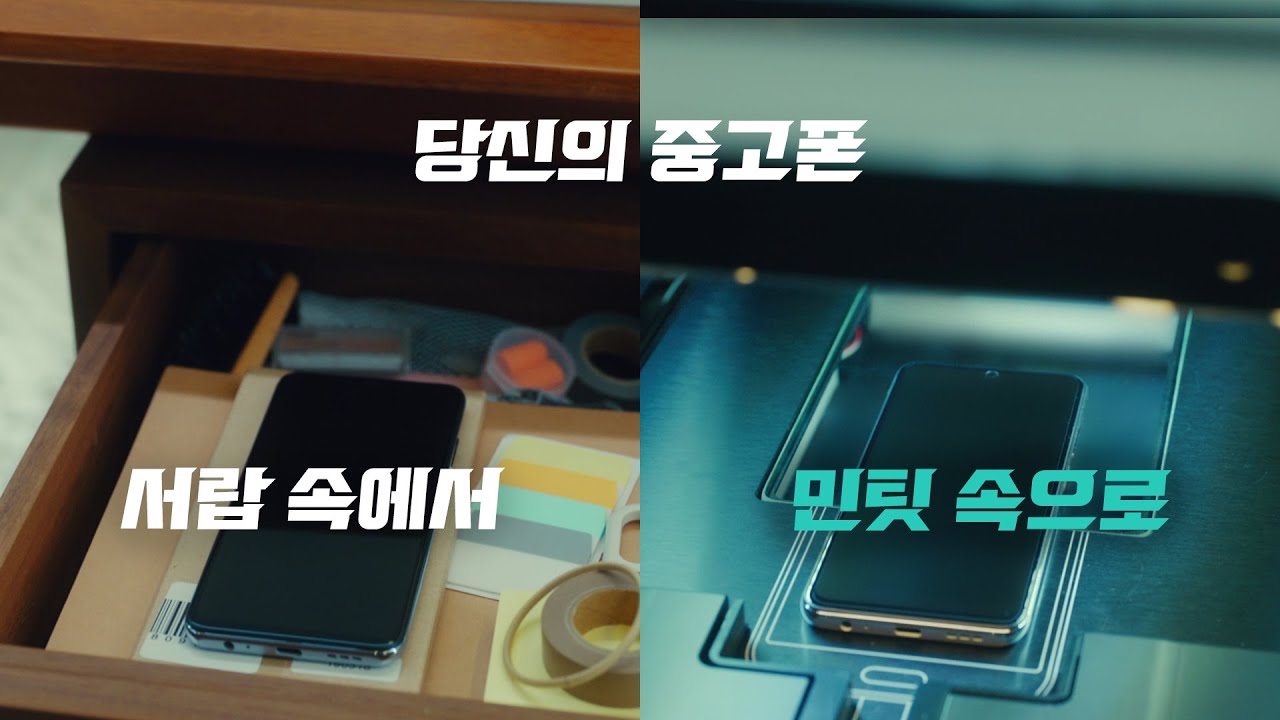

MINTIT, a Second-hand ICT Device Platform

MINTIT, a Second-hand ICT Device Platform

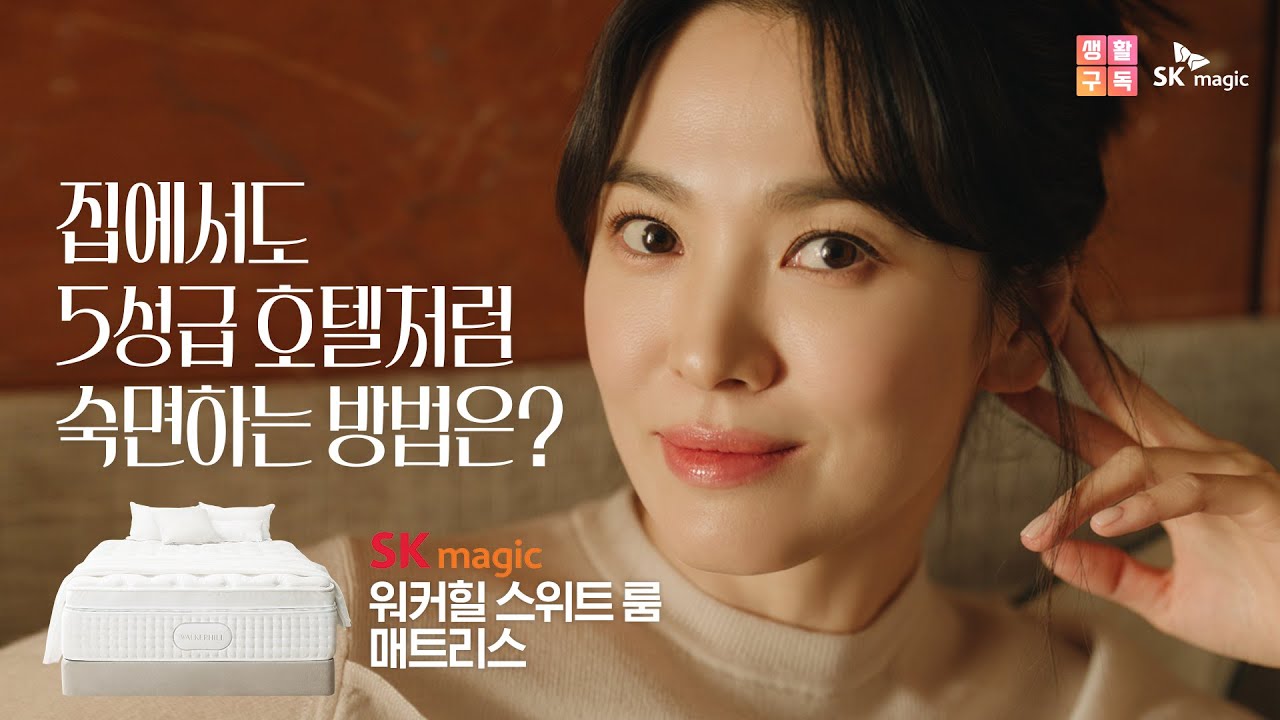

SK Magic Walkerhill Suite Room Mattress

SK Magic Eco-Clean food waste disposers

SK Magic One-cork ice dispenser/water purifier

SK Rent-a-car Long-term used car rental

2022 SK Rent-a-Car Direct

SK Magic Life Sub_ion

MINTIT x Yim Siwan

SK Rent-a-Car, Long-Term Individual rent-a-car 'Direct'

SK Rent-a-Car Direct

SK Magic Triple Care Dishwasher

Into the world of MINTIT

[Tire Pick] Norazo

SK Magic, a new way of life_Extraordinary

SK Magic, a new way of life_Constantly

2020 NEW Touch On Plus Dishwasher

Second-hand ICT Device Platform, MINTIT_Urban Mine

Second-hand ICT Device Platform, MINTIT_Transaction

Second-hand ICT Device Platform, MINTIT_Education

When buying tires, 'pick' them with Tire Pick

SK Magic Triple Care Dishwasher

Are you tired? : Tire Pick, the easy way to buy tires

SK Magic motion air purifier 30 Seconds

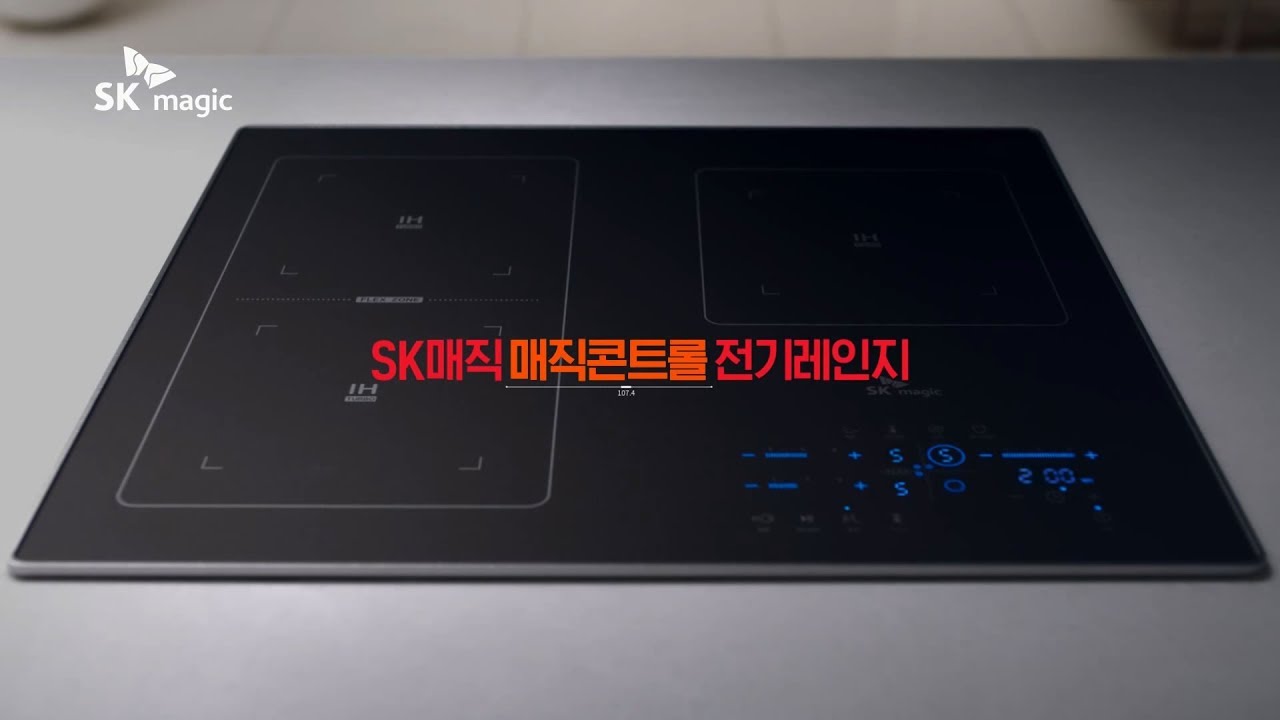

SK Magic Electric Range 30 Seconds

Speedmate Brand film (2018)

SK Magic Launch Ad 30 Seconds

SK Magic Launch Ad 15 Seconds

SK Magic’s Super Water Purifier & Ice Commercial

Vista Walkerhill Seoul PR Video

Grand Walkerhill Seoul PR Video