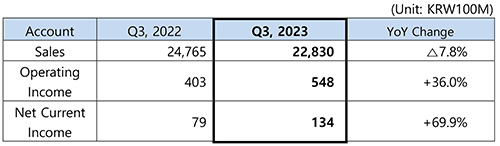

SK Networks posts 2.283 trillion won in Q3 sales & 54.8 billion won in operating income

-

2023-11-09

- Operating income up 36% YoY··· thanks to higher rental profitability & booming sales at Walkerhill

- Fully converting SK Rent-a-Car into a subsidiary & acquiring data solution company En-core

- “We will deliver greater value to shareholders by bolstering competitiveness and innovation as a business-oriented investment company”

SK Networks, a business-oriented investment company, has announced higher YoY earnings, raking in more revenue in spite of overall economic instability.

SK Networks (CEO: Hojeong Lee) disclosed on the 8th that they had posted 2 trillion 283 billion won in sales and 54.8 billion won in operating income in Q3 on a consolidated basis. YoY sales dropped 7.8%, but operating income jumped by 36%. Higher revenue from rental business as well as booming hotel business pushed the earnings to a new height.

SK Magic displayed better YoY performance, with sales and profitability growth in combination with the number of cumulative rental accounts including the global market exceeding 2.59 million. New products such as full-stainless steel spa bidet and borderless light induction series drew upbeat reports from customers and social outreach initiatives such as water purifier hygiene check campaign, etc. were also well received. Furthermore, SK Magic has kept rolling out new products that deliver higher value to customers one after another, including the All Clean The Art Air Purifier launched in October.

SK Rent-a-Car saw short-term rental sales fall on the account of YoY decline in Jeju-bound tourists but maintained the growth momentum of long-term rental business, with successful entrenchment of online distribution channels and diversification of rental offerings. In addition, booming export of used cars contributed to solid operating income.

Walkerhill saw exhibition, convention and casino visitors rising on the heels of increase in inbound tourists. Airport lounge and transfer hotel sales also rebounded to pre-pandemic level and the blockchain-based membership program ‘W.XYZ’ launched first time ever in Korea that allows customers to design services of their preference on their own drew positive attention.

In the ICT business domain, device sales shrunk slightly but revenue was maintained thanks to cost saving from operational efficiency gain in logistics centers, and SK Networks Service expanded network maintenance service coverage. MINTIT spearheaded fostering used phone trades, launching additional reward program for new phones that are based on AI algorithm and an excellent personal information deletion feature and accessible from over 5,600 used phone purchase ATMs across the country.

Speedmate raked in higher sales, with expansion of service offerings to include detailing service and ERS (Emergency Roadside Service). The Chemical Trading division maintained stable profitability, drawing upon long-term contracts. SK Electlink entrenched its presence as a leading EV charging infrastructure builder, increasing fast EV chargers to over 2,800 ea. and attracting more than 180,000 membership subscribers.

As a business-oriented investment company, SK Networks also invested in promising business areas. SK Networks invested in the AI-enabled wearable device developer ‘Humane’ as well as the AI-based smart farm solution startup ‘Source.ag’ in the 1st annual half, and decided to acquire the leading data management service provider ‘En-core’ in the 3rd quarter, finishing relevant procedures in October. En-core is the representative data management consulting and solution provider in Korea, serving 500 plus customers in various industries ranging from communications, to finance and mobility. In particular, the company has built up a differentiated market presence in the data management business domain, featuring one and only full-stack service lineup in Korea. En-core is expected to create synergy with various business datasets possessed by SK Networks. SK Networks also invested in the pet care startup BMSmile recently, fueling expectations for collaboration with SK Magic and Walkerhill.

Furthermore, SK Networks purchased and retired treasury shares in the 1st half of this year and its board of directors resolved to take onboard SK Rent-a-Car as a 100%-owned subsidiary in August. Converting SK Rent-a-Car into a fully-owned subsidiary is intended to improve shareholders value by addressing the duplicate listing issue. Follow-up procedures are expected to be wrapped up in next January.

Going forward, SK Networks vows to maintain stable growth trajectory by realigning business portfolio and optimizing operations to enhance revenue structures across parent company/subsidiary and improve its corporate value as a ‘business-oriented investment company’ that creates synergy and innovation by linking its incumbent business with promising future business domains like AI.

“We are implementing a model of virtuous cycle between investment and business as a business-oriented investment company,” an official at SK Networks said. “We will bolster competitiveness via innovation as a business-oriented investment company to make our financial story more complete, improve our corporate value and deliver greater value to shareholders.”

※ Attachment: Q3 Sales & Operating Income in 2023 (K-IFRS Consolidation)