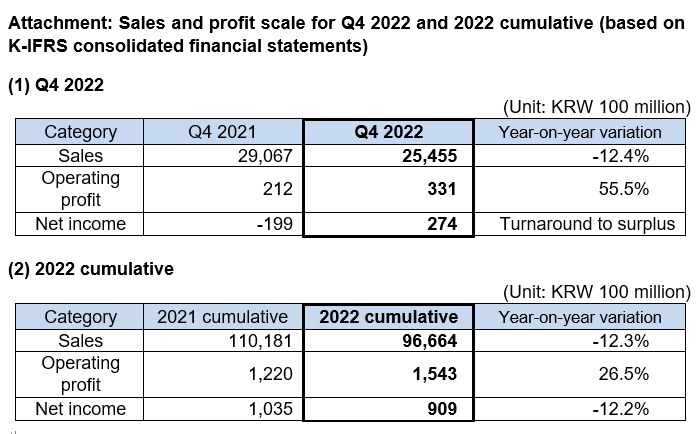

SK networks Q4 2022 records: KRW 2.5T in sales and KRW 33.1B in operating income, with an annual cumulative record of KRW 9.7T in sales and KRW 154.3B in operating income.

-

2023-02-10

- Profit increased year-on-year with continued favorable rent-a-car business conditions and reduced losses from the hotel business as COVID-19 becomes endemic.

- Efforts to achieve business stabilization and portfolio-building for future growth amid economic depression have shown results.

- “We will reinforce our corporate identity through enhanced competitiveness of our existing businesses and market verification of our new business values.”

SK networks achieved solid performance last year based on the continued growth of its rental subsidiaries including SK rent-a-car and SK magic and demand recovery from eased social distancing.

On February 10, SK networks announced through a provisional performance disclosure that it recorded KRW 2 trillion 545.5 billion in sales (12.4% year-on-year decrease) and KRW 33.1 billion in operating income (55.5% year-on-year increase) for Q4 2022 based on consolidated financial statements. Accordingly, it was reported that the company’s annual cumulative sales and operating income amounted to KRW 9 trillion 666.4 billion and KRW 154.3 billion, respectively. While sales decreased by 12.3% compared to 2021, operating income recorded a good year-on-year operating income (26.5% year-on-year increase) thanks to SK rent-a-car’s continued business performance and reduced losses from the hotel business due to the mitigated influence of COVID-19.

In the fourth quarter, SK rent-a-car’s sales and profit performance came from an increase in long-term car rental customers and strong used car sales. SpeedMate also demonstrated improved performance compared to the previous year as the import car parts business revived and social distancing restrictions were loosened. SK magic successfully increased the number of rental accounts to 2.42 million by launching products such as meal-kit sub_ions and mattress cleaning services that provide enhanced customer convenience. Walkerhill wrote a record of consecutive surpluses following the previous quarter thanks to various marketing effects in connection to year-end events.

2022 can be summarized as a year of stable performance achieved by existing businesses through flexible market response amid an overall economic depression while efforts were made to ensure portfolio diversity for future growth.

On its journey of transformation into an operation-based investment company, SK networks established an investment alliance with Silicon Valley-based MycoWorks, Sabanto, and LVIS while targeting blockchain as its new business area by strengthening its collaboration with Block Odyssey and Com2Verse. In addition, took over SSCharger-the no. 1 private brand for high-speed chargers, and made a share investment in EVERON-one of the low-speed charger suppliers, to accelerate the EV-related mobility business.

As part of its plan to convert all company vehicles to eco-friendly vehicles by 2030, SK rent-a-car replaced approximately 1,200 vehicles that accounted for 40% of EV short-term rentals in Jeju. It also opened a complex cultural and charging venue Eco Lounge at Seogwipo, Jeju. SK magic declared that it will take a leap forward into becoming a home life curation company and held the Living Sub_ion campaign while continuously introducing new products with enhanced functionalities and designs such as water purifiers, dishwashers, induction cookers, and food waste processors that reflect customer needs.

Walkerhill successfully reduced the large loss recorded during the previous two years. First, the number of hotel guests and demand for food and beverage increased with the eased social distancing. Second, the hotel released a variety of package products and promotions including a partnership with the Theatre des Lumieres and the launch of Walkerhill Gourmet Meal-kits.

Furthermore, efforts were made in the ICT and chemical trading businesses to achieve cost reductions and ensure client stability while SpeedMate sought new, ESG-based business opportunities including recycled import car parts. MINTIT recorded over one million used phone transactions for two years in a row based on continued cooperation with mobile phone manufacturers and other companies. Cartini, which runs a tire & battery shopping mall brand called TIREPICK, is striving to achieve a competitive edge by developing an application exclusively for TIREPICK and launching a next-day delivery service in the metropolitan area.

In celebration of its 70th anniversary this year, SK networks plans to achieve fundamental enhancement of its competitiveness through a differentiated competitive edge of its existing businesses and building a sustainable business structure by having the value of its new businesses verified by the market as independent business models. In addition, the company will upgrade its risk management system through uninterrupted cash flow management to prepare for uncertainties and carry out prudent and self-disciplined investment strategies.

SK networks’ General President Lee Ho-jeong said, “to lay a foundation for long-term growth, we will make clear SK networks’ identity and its reasons for existence and seek to facilitate its transformation into a sustainable business structure,” and added, “We will build a greater future with the aim of overcoming difficulties and opening a new way where lies the DNA of change and innovation that has continued for 70 years.”