SK networks Q3 2022 records: KRW 2.48 trillion in sales and KRW 40.3 billion in operating income

-

2022-11-08

- SK rent-a-car continues to perform well and Walkerhill makes a turnaround in the third quarter.

- Efforts are in place to foster new engines for growth including acquisitions of EV charging businesses and investments in promising future areas.

- “Investments will be made considering corporate synergy and ESG management to enhance the corporate value.”

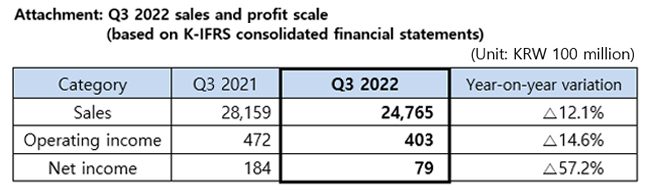

On November 8, SK networks (President & CEO: Sang Kyu Park) announced a provisional performance disclosure that it recorded KRW 2.48 trillion in sales (12.1% year-on-year decrease) and KRW 40.3 billion in operating income (14.6% year-on-year decrease) for Q3 2022 based on consolidated financial statements. (Q3 net profit decreased 57.2% year-on-year and recorded KRW 7.9 billion due to the underlying effect from selling low-efficiency assets in Q3 last year including the remaining portion of a gas station site.)

In this regard, an SK networks executive said, “A solid performance has been seen in the mobility field centered around SK rent-a-car, and the hotel business has also accelerated its efforts to return to normal business with a recovery trend in demand resulting from the mitigated impact of COVID-19.”

SK rent-a-car, while running Korea’s largest short-term car rental branch in Jeju island, continues to maintain a balanced performance and play a pivotal role for business growth thanks to favorable business conditions and increased profit from used car sales. The hotel business has made a successful turnaround through improved performance of outsourced transit hotels and lounge services as the number of airport passengers increased in addition to business recovery from guest rooms and F&B. The global business experienced a sales volume decrease because the steel business was brought to an end; however, the operating income marked a year-on-year increase due to the rise of oil prices and increased demand for chemical products.

For the ICT business, following the declining trend of new mobile phone device sales in Korea, both sales and operating income declined year-on-year. In the case of SK magic, despite the steady increase in the number of rental accounts, analytics revealed that intensifying competition in the home appliances market and costs incurred from IT system development have affected performance.

During the third quarter, SK networks continued to put efforts in exploring future growth engines while also providing support for its existing business areas including its subsidiaries to make further growth.

Earlier in July this year, an investment of USD 4 million was made in Sabanto, a U.S. automated tractor solution provider, and a Board of Directors’ decision was made in August to acquire the top private EV fast charging business (brand name: SSCharger) in Korea. Accordingly, SK networks will participate in the sub_ion of existing shares and paid-in capital increase of a new corporation, the establishment of which is planned by S Traffic through a split-off of the EV Charging business unit. Through this, SK networks will be investing a total of KRW 72.8 billion and have a stake of 50.1%. SSCharger was recently selected as the preferred bidder in a private competition for building EV chargers at highway service areas, which was hosted by the Korea Expressway Corporation. This allowed SSCharger to consolidate its position in the domestic EV charging market and objectively demonstrate its business competitive edge. SSCharger will provide services at 59 highway service areas for the next 10 years.

In addition, SK networks signed an MOU in August with Com2Verse, a company specialized in _verse technology, for strategic business cooperation and investment for building a _verse ecosystem. The MOU was arranged in an effort to pursue _verse business cooperation, which is considered a next-generation communication channel and new economic paradigm. In the future, SK networks will set up business zones for headquarters and subsidiaries in the space of an all-in-one _verse which is currently under development by Com2verse. The space will be where various tasks will be carried out and customer services offered.

SK networks will further actively engage in investments to create new business opportunities and, at the same time, internalize ESG (environment, society, governance) management elements into its business for sustained corporate value enhancement.

An SK executive said, “In the business management environment with intensified uncertainty, we will strive to maintain a competitive edge in our existing business areas in addition to making investments, and build capabilities to grow further in the future,” and added, “We will accelerate the evolution into a business model optimized for changing environment and internalize ESG management in an effort towards innovative corporate value.”