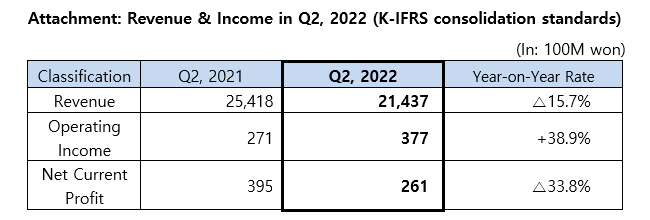

SK networks posts 2 trillion 143.7 billion won in revenue and 37.7 billion won in operating income in Q2

-

2022-08-02

- Car rental subsidiary sustaining growth and hotel losses easing by higher percentage… continuing to improve revenue from the same period last year

- SK car rental and SK magic roll out remarkable new personalized services

- “We will continue to upgrade existing business models and invest in boosting corporate valuation”

SK networks improved Q2 performance from the same period of the previous year thanks to upbeat business performance across business units including the car rental subsidiary.

On August 2, SK networks (President & CEO: Park Sang-kyu) announced in a disclosure of tentative business performance that the Company reported 2 trillion 143.7 billion won in revenue and 37.7 billion won in operating income in terms of consolidated performance as of Q2, 2022. The revenue fell by 15.7% when compared with the same quarter of the last year on the account of discontinuation of steel trading business and delay in the roll-out of new phones, etc., but the operating income jumped by 38.9%. (As the proceeds of the sale of Myongdong Building in the 2nd quarter of the previous year were reflected on the net current income which therefore reached 26.1 billion won, 33.8% down from the comparable period of the previous year.)

These performance figures are believed to have been boosted by solid earnings contributed by new businesses launched in mobility and home care divisions and expansion of service partnership as well as drastic easing of losses in hotel business thanks to the weaking of COVID-19 impact.

SK car rental that enjoyed a series of successes in short-term car rental services in Jeju and car resale market has launched new service offerings in the 2nd quarter to further improve convenience on the part of customers. The car rental subsidiary rolled out industry’s first ‘Polestar 2’ short-term car rental package to expand the range of electric vehicles available for rental customers and launched the ‘Smart At-Home Care Service’ which is an O2O (online to offline) car care service. SK car rental also kicked off a V2G (vehicle to grid) demonstration project to alleviate the imbalance between electric power supply and demand and thereby bolster up its presence as an eco-friendly rental mobility company.

Furthermore, SK networks officially released ‘THE CARPET’, an imported car care application, in April, and the online tire/battery mall ‘Tire-Pick (corporate name: Cartini)’ is also solidifying its presence as a new customer destination in the automotive aftermarket, expanding tire lineups and launching various promotional events.

SK magic remained on the growth track, launching new businesses and marketing new product models. SK magic entered the mattress rental market by launching the bed rental and care service ‘ECO hue’ in May and debuted the ‘Eco-Clean Food Waste Disposer’ with a dehumidification feature built-in for the first time in Korea in June. The company also rolled out new models of water purifier, dish washing machine and induction oven one after another to make more choices available to customers. Thanks to these moves, the number of SK magic’s cumulative rental accounts exceeded 2.3 million as of the end of the 2nd quarter.

As the adverse effects of COVID-19 began to fade away, Walkerhill saw its room and food/beverage sales rebound and set about diversifying businesses, with ‘Walkerhill Gourmet Premium Meal Kits’ marketed and the ‘Theater of Light’ exhibition opened. Mintit enhanced marketing partnership with mobile phone makers and boosted cooperation with such social enterprises as TES, LabSD, OHFA Tech, etc. to elevate brand equity. SK network service also made preparations for smart factory deployment projects in the 2nd quarter, being allocated with the e-UM 5G program frequency by the Ministry of Science and ICT (MSIT).

In the 2nd annual half, SK networks will continue to prop up the growth of its businesses and subsidiaries, with keen eyes on changing economic and social landscapes in Korea and elsewhere around the world. The Company also vows to further accelerate investing in future-centric promising areas and linking such areas to business. “We have garnered solid performance in the 1st annual half primarily thanks to rental subsidiaries and strategically invested in promising technologies of the future encompassing EV charging, eco-friendly materials, blockchain, etc. to further expand our global investment portfolio,” said an official at SK networks.” “SK network will evolve into a ‘business-centric investment company’ by continuing to launch new investment initiatives and grafting them with businesses.”