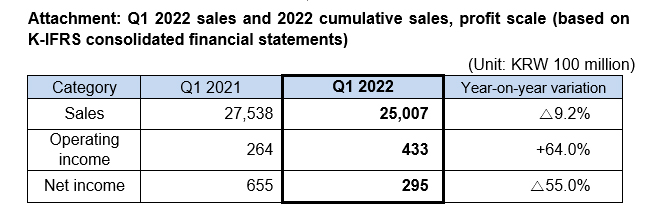

SK networks Q1 2022 records: KRW 2.5 trillion in sales and KRW 43.3 billion in operating income

-

2022-05-09

- The operating income increased year-on-year by 64% through an upswing in the performance of rental subsidiaries and reduced loss in the hotel business.

- Much attention is given to an ESG-linked service as well as new customer-tailored products in the mobility and household appliance areas.

- New investments are also made for the transition into an operation based investment company... “to become an enterprise that lives up to the market’s expectations.”

SK networks received its Q1 2022 earnings report with its profits increased year-on-year thanks to robust earnings created from the rental subsidiaries and reduced loss in the hotel business resulting from the relaxation of COVID-19 social distancing restrictions.

On May 9, SK networks (CEO: Sang-kyu Park) announced through a provisional performance disclosure that it recorded KRW 2.5 trillion in sales and KRW 43.3 billion for Q1 2022 based on consolidated financial statements. While the sales were inevitably impacted by the ICT device sales issue due to the global shortage of semiconductors (9.2% decrease in sales), the operating income increased year-on-year by 64.0%. (However, in the case of Q1 net profit, decreased year-on-year by 55.0% because the amount collected in Q1 last year for selling a Chinese mining company impacted )

More specifically, SK rent-a-car and SK magic that are the Company’s key rental subsidiaries have led the industry with a continued growth trend by launching new products that satisfy customer needs and ESG management.

SK rent-a-car has enjoyed profits from used car sales and increased demand on domestic travel centered on jeju. It has also increased customer value by launching a series of new products such as SK rent-a-car Tago Pay and online-only service for used car rental. In addition, it reinforced its position as an eco-friendly car rental service provider by acquiring an approval from the Ministry of Land, Infrastructure and Transport for its greenhouse gas emission reduction project co-developed with SK telecom and by launching a long-term Polestar 2 rental product, which is unprecedented in the industry.

SK magic achieved 2.24 million accounts cumulative as popular products including Triple Care Dishwasher and All Clean Air Purifier have been continuously well received by customers. SK magic is further expanding its Green Collection, an eco-friendly household appliance lineup, with Eco Mini Water Purifier Green 41 launched in January this year. Moreover, a premium vacuum cleaner has been added to the Special Rental Service unveiled last year in collaboration with Samsung Electronics, making 6 product types available in total. In an effort to extend the business boundaries, SK magic has launched LatteGo, a coffee-machine rental service early in March in partnership with Philips Domestic Appliances Korea.

Walkerhill managed to drastically reduce the magnitude of loss as hotel rooms and F&B sales have improved thanks to the relaxation of COVID-19 restrictions. The business is also striving to promote wedding∙seminars as customers are getting back to normal life. MINTIT, the ICT recycle brand has contributed to developing the culture of used phone distribution through its customer reward program run in Q1. In addition to a recent release of a new campaign video highlighting the technology for removing personal information, MINTIT is planning various customer engagement activities such as opening pop-up stores.

SK networks has moved even further to reinforce investment in and business partnership for diverse fields including AI, digital technology, ESG and blockchain under the strategy to identify new promising areas and enhance the corporate value. Building upon the investments in Everon, a low speed EV Charge Point Operator and MycoWorks, an eco-friendly alternative leather company, investment was also made in the blockchain field such as Hashed Ventures and Block Odyssey. The Company is accelerating investment portfolio diversification and the search for new growth engines through these investments.

SK networks will continue its efforts beyond Q2 to add value as an operation based investment company while at the same time seeking to earn more trust from the stakeholders through reinforced competitiveness of the existing businesses. An SK networks executive said, “Not only will we continue to grow the businesses that achieved success in Q1, we will extend the business boundaries of the import car parts business and new subsidiaries such as MINTIT and Cartini (Brand name: TIREPICK) so as to create performance that lives up to the market’s expectations,” and added, “We will upgrade the existing business models connecting them with new investments and search for new growth engines as well.”.