SK networks 2020: KRW 10.63 trillion in sales, KRW 123.7 billion in operating income

-

2021-02-05

- Profit increased in growing businesses even under the COVID-19 pandemic... Business structure upgrade was successful

- One-time losses (e.g. losses on valuation for closed down businesses) are reflected in 4Q, eliminating future uncertainties

- ”Growth in home care, mobility will be expedited... Will respond to non-contact trends and build an ESG base”

It was demonstrated that SK networks retained a robust profit structure centered around future growing businesses last year despite the COVID-19 influence.

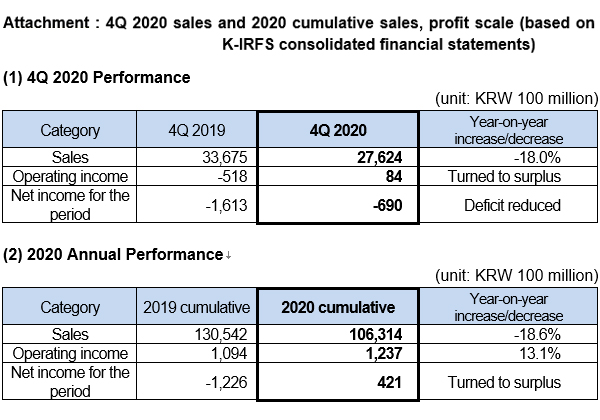

On February 5th, 2021, SK networks announced through a provisional performance disclosure that it recorded KRW 2.76 trillion in sales and KRW 8.4 billion in operating income for 4Q 2020 based on consolidated financial statements. Sales decreased by 18.0% and the operating income turned to surplus based a year-on-year comparison. As a result, the cumulative annual performance recorded sales of KRW 10.63 trillion (18.6% year-on-year decrease) and an operating income of KRW 123.7 billion (13.1% year-on-year increase).

While major influences that affected 4Q 2020 were COVID-19 and off-season, operating income and net income losses for the period due to one-time factors including valuation losses for closed-down overseas businesses incurred from selling off Australian Resources Corporation and impairment of deferred income tax assets. However, these losses eliminated the possibility for potentially increasing losses in the future; thus, providing a solid foundation on which sustained growth and stakeholder (e.g. shareholders) value enhancement can be achieved.

2020 performance can be summarized as a year that future key businesses demonstrated their value by generating higher profits than the previous year through continued launching of new products and services that reflect customer needs in the areas of growing businesses such as home care (SK magic) and mobility (SK rent-a-car).

Much favorable responses were given to SK magic releases of the Triple Care Dishwasher, All-Clean Air Purifier and Water Purifier for Self-Maintenance series that were well-timed for increased hygiene concerns. Each released product had added technology and design capabilities as well as laying a foundation for green portfolio expansion, for example, by applying eco-friendly plastic (PCR-ABSS) on All-Clean Air Purifier. This encouraging environment helped SK magic achieve a sales of KRW 1 trillion and reach more than 200 million rental accounts. SK magic remains successful in keeping a steady growth since it was taken over by SK networks end of 2016.

After its new start as a joint corporation last year, SK rent-a-car spent a meaningful year as well. By integrating vehicle purchase and maintenance, insurance, short-term inland rent-a-car service, and other processes, not only was the operational efficiency increased but the number of approved vehicles went beyond 200,000. In addition, the newly released short-term rental service for Tesla EVs and EV all-in-one package envisioned a future model for the rent-a-car industry. As well, it recently announced a plan to expand eco-friendly rental cars and issue green bonds for greenhouse gas reduction. SK networks also provided enhanced customer convenience by developing an application where imported car parts can be ordered easily through SpeedMate and introducing a service via TIREPICK for users to retrieve tire∙battery information based on the vehicle registration number.

While mobile device sales have declined in the ICT business, the used phone recycling business and ICT lifestyle business expansion were successful through Mintit and April Stone, increasing the quality of the social value creation model linked business models.

Despite that, the situation was adverse to Walkerhill as it had no choice but to accept a significant amount of business losses for not being able to sell rooms and operate the buffet restaurant. In an effort to provide an expanded customer service, it launched Le Passage, a premium gourmet store and opened the renewed Myongwolgwan.

Along with this, SK networks rearranged investment sources for growth by handing over direct gas station operations and PinX as well as selling its office building in Myeongdong last year, which resulted in increased financial stability. FinanceAsia, the global finance journal selected SK group as the best local M&A case in 2020, showing the example of SK networks which divided its direct gas station operations into assets and businesses before selling them to multiple buyers.

This year, SK networks plans to make continued efforts in reinforcing the growing businesses - home care and mobility; increase its response to the non-contact trend using AI (artificial intelligence) and DT (digital transformation); and, actively engaged in building a foundation of ESG management with a consideration on both the society and environment.

An SK networks executive said, “Our goal is to make a company in which business model innovations, corporate value enhancement and social value creation all go together. This can be achieved by upgrading implementation strategies by business unit to overcome uncertain environments and transform them into opportunities that will add to the company’s story of growth. Ensuring new additional growth engines will also add to this.” The executive added, “For this goal, we will raise the digital capabilities of our members in the great place to work culture and establish a strong customer-centered and horizontal corporate culture.”